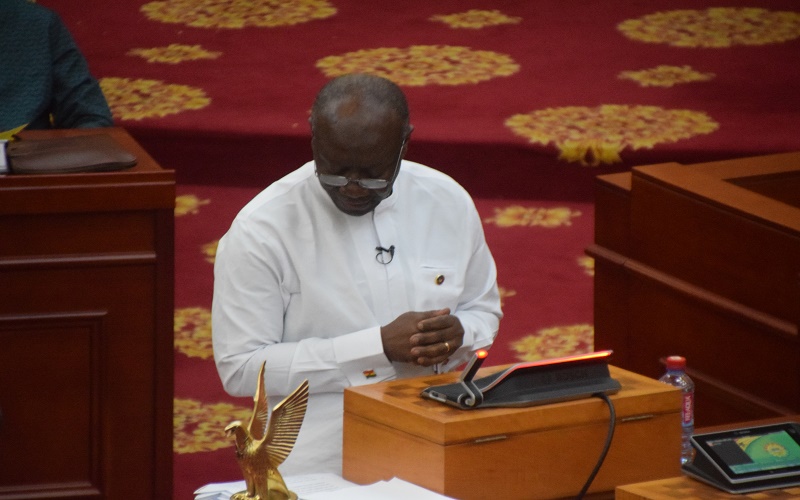

Ken Ofori-Atta, the Minister of Finance, has told Parliament that the pragmatic measures embarked upon by the President Akufo-Addo-led government to clean the banking sector has yielded fruitful result by saving 3,000 jobs and secured distressed deposits of some 2,655,100 customers.

This, he noted, has spurred growth in the sector, with the banks’ assets recording an outstanding GH₵112.8billion with the growth of credit to the private sector also rebounding to appreciable levels.

“Mr. Speaker, we have restored confidence into the banking system, securing the otherwise distressed deposits of some 2,655,100 customers, as well as saving over 3,000 jobs. Today, total banks’ assets have shot up to GH¢112.8 billion. Growth of credit to the private sector is rebounding assuredly by 16.8% in June 2019. I am, therefore, happy to announce confidently that Ghana is seeing the revival of that zealous, responsive and, at the same time, responsible banking environment we had been reduced to reminiscing”, he noted.

Mr. Ofori-Atta made this observation when he moved a motion on the floor of Parliament on Monday, July 29, 2019, for the approval of the Mid-Year Review of the Budget Statement and Economic Policy of the Government of Ghana and Supplementary Estimate for the 2019 Financial Year.

Continuing, he said as result of the bold and decisive measures the government took to fix the banking crisis, banks in the country are now stronger and richer, with the cost of borrowing also dropping.

He said with a stable environment provided by the government in the banking sector, “banks can and should, therefore, do a lot more to support the growth and expansion of business which will create more job”.

The banking sector of Ghana was hard-hit with liquidity challenges as a result of under capitalization. This provoked the Bank of Ghana (BoG) to institute some immediate measures to save the sector from collapsing.

The recovery process saw BoG brought up some of the distressed banks together by setting up the Consolidated Bank Ghana Limited and capitalized it with GH¢450 million.